Some ideas for solving the college debt/student loan problem

I like to solve organizational problems. Here’s an attempt to address the problem of student debt.

Fixing a problem is easy. The hard part is clearly defining what the problem is. Once you clearly define a problem then you can in fact fix the problem. You just have to be willing to execute the solution.

Admittedly, I don’t clearly know what the problem is. However here’s some components of the problem as I understand them.

We are passing along debt. Colleges have to have awesome facilities in order to attract students. So they have built new blds, dorms, sports fields etc… and remodeled old ones. This has caused debt for the college. Which in turn must be passed on to students to pay for the debt. Hence increased tuition which often requires student loans.

The government is making it way to easy for loans to be acquired.

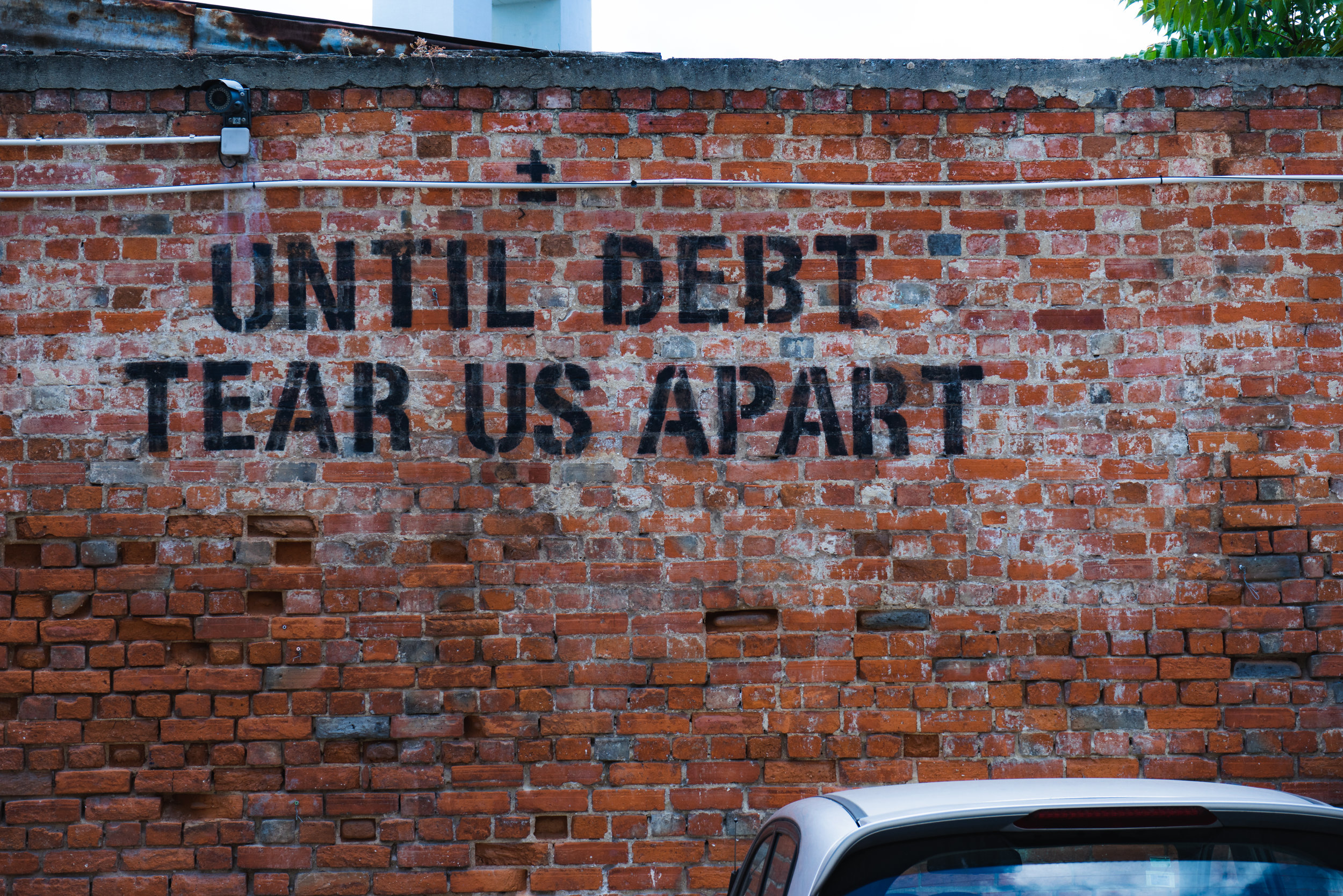

We are ruining kids futures with debt. A person should not be starting off career and family with debt. This simply cripples them for decades to come if not for their entire life. If a young person can begin contributing to their retirement fund rather than school loans they’d retire millionaires easily and early. Dave Ramsey has already done the math on this one. Parents need to know why they should attend your school rather than others. Here’s the reason: Our college won’t ruin your future with debt…we’ll let other colleges do that.

Student debt is also ruining the future of the church. One of the greatest reasons an adult can’t/won’t contribute financially to their church is due to college debt.

Some principles that must be embraced in order to eliminate debt

Tuition has to decrease while quality increases. Yes, that’s a tall order.

Students should not be allowed to take loans. The bible speaks of loans negatively 100% of the time. We should honor that and see what God can do. At a minimum we must stop allowing those who will become pastors, missionaries, social workers, educators, public service employees and perhaps others to incur debt at the college educational level. Debt can and will stop you from being able to do God’s work. There is no harm in requiring them to pay cash and take an extra year or two to complete their degree. This would be a tremendous way for the college to serve the students and their future churches.

Don’t make our problems your problems. The college should not pass on their problems to the students. It’s your debt not theirs.

We must embrace collaboration. I’m not wanting anyone to lose their job but I can certainly see leveraging a faculty to serve multiple schools who are aligned together. Virtual works.

College must expand their influence to brand new parents. If parents would begin saving in a 529 when their children are babies they would have saved plenty to pay for school. Colleges target high schoolers, especially seniors, and they should. But what would happen if we began “nursery recruiting” and helping new parents set up college funds. Send a baby blanket with college logo on it and a 529 application to every baby born.

Below are some of my ideas to solve this issue. I’m not sure if any of them are good…but at least they are ideas.

3 months model

In response to Covid-19 many colleges (including the school where my kids attend) have started school early and will end the semester at Thanksgiving. They will pick back up in mid Jan for the spring semester. This model is creating a great opportunity. This model would be 3 months in school then 3 months working. You can make enough in 3 months to pay for the next three months.

Here’s some simple math: If you work 40 hours a week at $13 an hour = 520 per week (gross) = $6,760 for three months (gross). If you add on a side hustle you can make lots more.

Schools could set tuition to be what a student can make during three months (plus various scholarships). This gives every single student a plan to fully pay for college.

I know this can happen. My son took full advantage of the shut down this past summer. He worked a 40hr a week job and also had a side hustle with instacart. He made over $8000 net and paid off his fall tuition before school began. He plans to do the same thing this winter.

I realize this affects school community life and sports. But again, solving a problem requires being willing to solve the problem.

Learn from Y-combinator

Y-Comb is a accelerator/mentor program for entrepreneurs in CA. If accepted to this program they give you $150,000 in exchange for 7% of the business you are creating. When the business is grown Y-Comb cashes out and makes a killing. At least with those who make it big.

Colleges could offer a similar approach to students seeking an entrepreneur degree. A scholarship in exchange for a percentage of the business you will start after college.

This has the potential to create future and ongoing endowments as lots of alumni go on to start businesses that do well.

And…it’s so much better to create a job than to find a job. Our colleges should embrace this vision.

Learn from prisons

I mean that to be a bit tongue-in-cheek. :) Prisons often have factories or businesses in which the inmates work. The inmates are paid and the prison profits from the business.

Colleges could start businesses as well that would be for-profit. Like a bank, in which people invest their 529’s.

Alumni University

I’m not sure if that’s a good name but here’s the idea: Online courses being provided by alumni as a means for supplemental income for the school. Kind of like kajabi. Alumni can post online courses in their field of expertise. The school and the alumni can split the profits. The alumni get the benefit of the colleges network and the college gets the benefit of the alumni’s expertise. Obviously this can always be expanded to non-alumni.

Learn from Fiverr

Fiverr is a freelance website where people can offer their services for hire. Through a college provided portal the alumni of a university can offer their services for hire, literally around the world. And like the previous idea, the college and alumni would split the profits. The larger the endowment or for-profit arm of an university the easier it will be to eliminate debt.

Buy up the town

What if a college owned multiple businesses in the city/area in which it is located? They would be able to provide jobs for students and profit from the business to subsidize the school. The profit from this and other endeavors can be used to service the debt load of the school or to pay teachers rather than putting that on the students, thus lowering tuition. Kind of a no-brainer in my opinion. There are in fact many businesses that make a lot of money. It would benefit the college to own a few of them or at least be investors.

Go to 4+ years

College was awesome who wouldn’t want another 6 months or a year Instead of taking a full load each semester simply take a 3/4 load and pay cash for it. I can even envision a 5th year that’s a transitional year from college to career life. Spreading the load out spreads out the tuition and gives students more time to work and pay for school

Well, there’s my ideas so far.